Another limitation of the Accounting Equation is that it can’t tell you if the company’s records are accurately recorded. A balanced Accounting Equation by itself is insufficient to certify the accuracy of a company’s records. A company’s accounts and Balance Sheet can balance and still for the entries to be wrong.

What if any one of these elements changes?

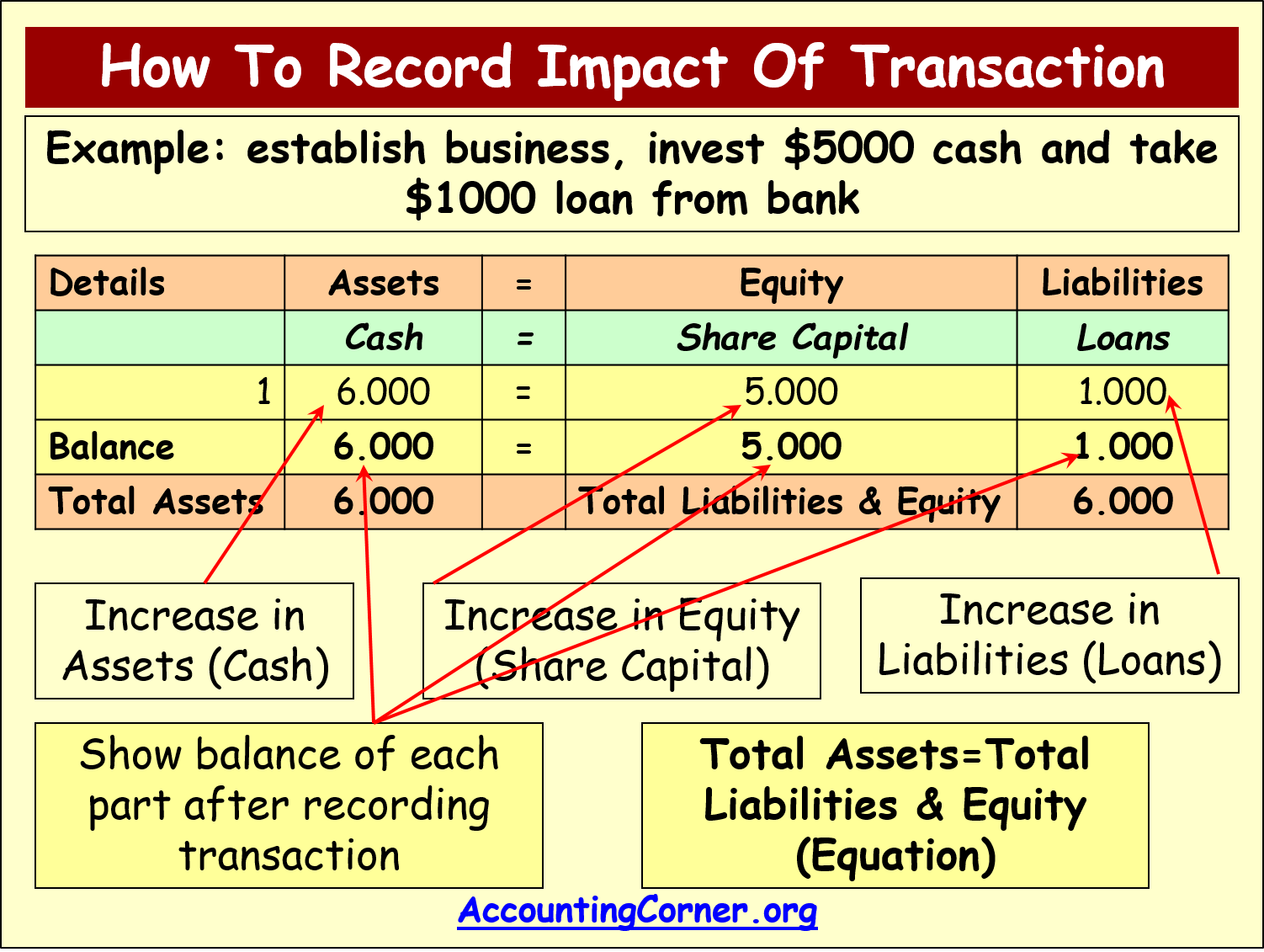

The income statement will explain part of the change in the owner’s or stockholders’ equity during the time interval between two balance sheets. In above example, we have observed the impact of twelve different transactions on accounting equation. Notice that each transaction changes the dollar value of at least one of the basic elements of equation (i.e., assets, liabilities and owner’s equity) but the equation as a whole does not lose its balance.

What is the approximate value of your cash savings and other investments?

- Owner’s or stockholders’ equity also reports the amounts invested into the company by the owners plus the cumulative net income of the company that has not been withdrawn or distributed to the owners.

- Before taking this lesson, be sure to be familiar with the accounting elements.

- Said differently, it states whatever value of Assets left after covering Liabilities is entitled to Equity holders.

As inventory (asset) has now been sold, it must be removed from the accounting records and a cost of sales (expense) figure recorded. The cost of this sale will be the cost of the 10 units of inventory sold which is $250 (10 units x $25). The difference between the $400 income and $250 cost of sales represents a profit of $150. The inventory (asset) will decrease by $250 and a cost of sale (expense) will be recorded.

Company

For instance, if a business takes a loan from a bank, the borrowed money will be reflected in its balance sheet as both an increase in the company’s assets and an increase in its loan liability. This straightforward relationship between assets, liabilities, and equity is considered to be the foundation of the double-entry accounting system. The accounting equation ensures that the balance sheet remains balanced. That is, each entry made on the debit side has a corresponding entry (or coverage) on the credit side. This straightforward relationship between assets, liabilities, and equity is the foundation of the double-entry accounting system. That is, each entry made on the Debit side has a corresponding entry on the Credit side.

Using Apple’s 2023 earnings report, we can find all the information we need for the accounting equation. This arrangement can be ideal for sole proprietorships (usually unincorporated businesses owned by one person) in which there is no legal distinction between the owner and the business. For example, John Smith may own a landscaping company called John Smith’s Landscaping, where he performs most — if not all — the jobs. Metro Corporation collected a total of $5,000 on account from clients who owned money for services previously billed. During the month of February, Metro Corporation earned a total of $50,000 in revenue from clients who paid cash. This transaction also generates a profit of $1,000 for Sam Enterprises, which would increase the owner’s equity element of the equation.

To learn more about the balance sheet, see our Balance Sheet Outline. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Unearned revenue from the money you have yet to receive for services or products that you have not yet delivered is considered a liability.

And Accounting Equation is the premise on which the double-entry accounting system is built. This long-form equation is called the expanded accounting equation. Metro Courier, Inc., was organized as a corporation on January 1, the company issued shares (10,000 approve and authorize an expense claim in xero shares at $3 each) of common stock for $30,000 cash to Ron Chaney, his wife, and their son. The $30,000 cash was deposited in the new business account. They include accounts payable, tax payable, accrued expense, note payable, pension fund payable, etc.

The value of the house after deducting the liability belongs to you, which is $80,000. Metro Corporation paid a total of $900 for office salaries. Metro Corporation earned a total of $10,000 in service revenue from clients who will pay in 30 days.

On 1 January 2016, Sam started a trading business called Sam Enterprises with an initial investment of $100,000. The effects of changes in the items of the equation can be shown by the use of + or – signs placed against the affected items. For every business, the sum of the rights to the properties is equal to the sum of properties owned. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com.

Instead of recording the purchase of the chair for $100, for example, they could record it at $10. So it can tell you if the records are wrong, but it can’t certify if the records are accurate. Suppose a company spends $100 to purchase a chair with cash. The company’s PP&E value increases by $100 because it now owns an extra chair worth $100.