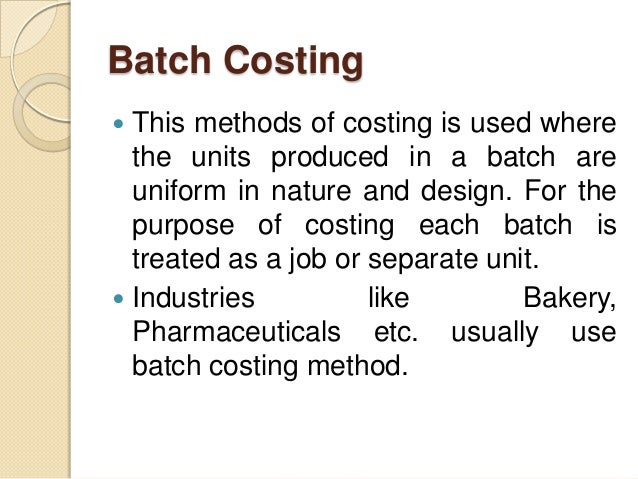

The marginal or variable cost of sales includes direct material, direct wages, direct expenses and variable overhead. Where the cost of a group of product is ascertained, it is called ‘batch costing’. Costs are collected according to batch order number and the total cost is divided by the numbers in a batch to find the unit cost of each product. Batch costing is generally followed in general engineering factories which produce components in convenient batches, biscuit factories, bakeries and pharmaceutical industries. Absorption Costing – Absorption costing is also referred to as full costing. It is a costing technique in which all manufacturing cost (fixed and variable) are considered as cost of production and are used in determining the cost of goods manufactured and inventories.

Related Services

While financial accounting presents information for external sources to review, cost accounting is often used by management within a company to aid in decision-making. Cost accounting can be beneficial as a tool to help management with budgeting. It can also be used to set up cost-control programs, with the goal of improving net margins for the company in the future. This enables the performance comparison of different undertakings to be undertaken easily and effectively, leading to the common advantage of all participating undertakings. This differs from marginal costing in that some fixed costs could be considered to be direct costs in appropriate circumstances. We serve the needs of affordable housing, construction, family-owned businesses, healthcare, manufacturing and distribution, and nonprofit industries.

Most widely used costing methods

To ensure the long-term viability of a company, it is crucial to comprehend how these factors affect pricing. These details enable the management team to eliminate or to pull back on any activities that do not generate a sufficient amount of profit. The ascertainment of cost and the provision of knowledge about its constituents are the two broad objectives of costing. Therefore, both terms can be used—and often are used—in the same sense. Cost accounting utilizes several cost classification approaches to suit different managerial needs.

How confident are you in your long term financial plan?

Each job can be separately identified, so it becomes essential to analyse the cost according to each job. This method is applicable to printers, machine tool manufacturers, foundries and general engineering workshops, interior decorator, painters, repair shops etc. The raw material passes through a number of processes up to a completion stage. The finished product of one process passed through a number of process for the next process. A cost element refers to an account which receives and accumulates costs over a period of time.

- Kaizen costing also helps you manage risk better because it gives you valuable information about where money is being wasted and where it’s being saved.

- This enables an organization’s managers to know not only the total cost but also its constituents.

- Actual costing is a method where the cost that you assign to a product is based on the actual expenses that your business incurred during its production.

- It refers to the determination of cost of operations; the cost unit is the ‘operation’ instead of the process.

As such, this procedure does not enable the manufacturer to take corrective action in time. This method is mostly used in industries where ready-made garments, chip manufacture, etc have occurred. Since the 1980s, the world has seen quick technical and production advances, including in automation and computer usage, leading to decreased employment.

What you’ll learn to do: Examine the benefits and limitations of both cost accounting methods

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Additionally, continuous costing does not disclose what the cost of the job ought to have been. However, a serious drawback of post costing is that it is historical in nature. This is because the information is obtained after the events have already taken place.

Liabilities can be recorded using the historical cost concept as well. It doesn’t matter how small your business is; your assets are important. Cost accounting has more latitude than other types of accounting because there are no rigid requirements it must follow. Cost accounting seldom fails a company’s management team and, consequently, the enterprise.

You don’t need to keep track of every little purchase price throughout an accounting period. However, a business with variable yearly costs may not recover the costs of more expensive products under this method. The costing method you implement can either improve profitability or hinder it – that’s why choosing the audit working papers appropriate tactic is vital. Discover the key costing methods for manufacturing and inventory accounting and when to use them in this complete guide. When ABC is used correctly, it can help businesses make better decisions about pricing and budgeting by ensuring that all costs are included in their calculations.

This blog post will explore different costing methods and their implications, empowering you to make informed decisions that optimize your pricing strategy and boost your bottom line. So, let’s dive in and discover the right costing method to help your business thrive. In traditional accounting, profit and loss are calculated by subtracting expenses from income, whereas the goal of cost accounting is to be cost-effective by lowering project, process, and manufacturing costs.

In both of the above examples, we are assuming that the company produced and sold 2,900 books using a Just-in-Time inventory management system, and therefore, operating income for both statements is $1,530.00. Cost estimates are often required for bidding for contracts or for offering quotations of prices in respect of jobs to be undertaken. Extreme care has to be taken in cost estimation, as a high quotation may result in a loss of business and a low quotation may lead to lower profits or sometimes losses.

By comparing actual and standard costs, the company can determine whether it has achieved its goal of providing products or services at a particular cost. In this example, each product’s overhead costs are allocated based on the resources required for each activity. This allows the company to determine the true cost of producing each product and make informed decisions about pricing and production levels. Variable costing is useful when the company needs to determine the cost of production for a particular product quickly or when it needs to make decisions about pricing or production levels.