В этой подборке курсы для тех, кто задумывался о трейдинге, но не решался применить свои знания без практики. Курсы разные по интенсивности, но точно с хорошей базой знаний и практической частью. Узнаете про рынок, индикаторы и стратегии, а также разберетесь с платформами для трейдинга. Также мы собрали онлайн-курсы для прокачки знаний и навыков тем, кто уже начал совершать первые сделки на бирже. В сети представлено большое количество информации о том, как отслеживать котировки, выставлять заявки, устанавливать цену на активы и закрывать сделки. Однако наиболее оптимальный способ точно разобрать в теме и без рисков совершить первые сделки — пройти курсы по трейдингу.

Лучший экспресс-курс по трейдингу

В основе лежит особенность, которая указывает, что стратегия, применяющаяся в торгах, в независимости от ее вида является сводом правил и набором обязательных к исполнению действий. Для того, чтобы достигнуть успеха, торгуя и заключая сделки на бирже, необходимо знать основные стратегии трейдинга. Начинающие трейдеры зачастую не понимаю, что такое торговые стратегии. Их часто путают с видами и стилями трейдинга, которые была разобраны выше, однако они не имеют практически ничего общего.

Выучите особенности интерфейса, аналитический инструментарий, процесс настройки торговых стратегий. Рассматривают разные виды eto razvod брокер крипто-ботов, рассказывают про их оптимизацию для автоматизированной торговли. Полезный видеоурок, посвященный торговле P2P (peer-to-peer) и арбитражу в этом сегменте.

Начинающие инвесторы часто задают один и тот же вопрос — сколько нужно средств, чтобы начать зарабатывать или торговать на фондовом рынке? Начать можно и с десятка долларов, однако наиболее точно ответить на этот вопрос поможет выбранный вид трейдинга. Те, кто ориентируется на средний срок, могут удерживать позиции начиная от нескольких месяцев, а заканчивая годами.

Почему важно торговать по стратегии и какие есть системы в трейдинге, система для внутридневного трейдера, торговые решения для трейдеров в 2022 году. Выбор посредника между трейдером и селлером активов является важной частью для каждого игрока на рынке ценных бумаг. Правильный выбор позволит торговать на комфортных условиях, а некоторые брокеры лояльно относятся к начинающим и предлагают интересные бонусы, например, на первый депозит. Высокая волатильность рынка криптовалют предоставляет возможности для быстрого роста, но также несет риски. Трейдеры используют тактики, такие как дневная торговля, долгосрочные инвестиции и арбитраж для получения прибыли. Успешные трейдеры в этой сфере должны быть гибкими, информированными и готовыми к быстрым изменениям на рынке.

Трейдинг, как и любая другая профессия, требует усидчивости, терпения и неустанного труда. Оставьте заявку и вам помогут разработать индивидуальную инвестиционную стратегию, определить ваш уровень и подобрать оптимальный для вас курс. Базовая программа — это лучший продукт для старта в области инвестиций.

Поэтому лучше заранее подготовить себя к потере средств на трейдинге. Так вы морально будете готовы и определите бюджет, который не будет для вас катастрофой при проигрыше. Если вы интересуетесь инвестированием, умеете справляться со стрессом и ищите интересную профессию, которую можно довольно быстро освоить, — подумайте про трейдинг. С чего начать погружение в эту сферу, вы уже знаете из этой статьи. Собрали наиболее важные вопросы о профессии трейдера и первых шагах на бирже. В первую очередь нужно гнаться не за деньгами, а за мечтой и идеей.

Стратегии

Эффективные стратегии в сфере трейдинга сочетают анализ данных и грамотное управление рисками. К примеру, долгосрочные инвесторы зачастую предпочитают стратегию «Buy and Hold», в то время как активные трейдеры применяют технический анализ для определения точек входа и выхода. В этом разделе, вы сможете познакомиться с наиболее продуктивными трейдерскими стратегиями, включая «скальпинг», «мартингейл», «трендовая торговля» и т.д. Полученные знания позволят подбирать самые эффективные стратегии, учитывая изменения на финансовых рынках. За 6 месяцев на курсе вы поймете, как функционирует финансовый рынок.

- Это особенно важно знать для начинающих трейдеров, поскольку заходить на рынок необходимо только после тщательного анализа ситуации и тенденции.

- Трейдинг представляет из себя искусство успешной игры на финансовых рынках.

- Подобная стратегия в трейдинге предполагает, что торговля, осуществляемая человеком на финансовых рынках проводится в равной степени ручным и автоматическим методом.

- На фондовых рынках активно применяются самые разнообразные стратегии, поэтому выбирать их нужно индивидуально.

- Если хотим приобрести одежду — покупаем онлайн или едем в торговый центр.

Как заработать в крипте на фьючерсах? Как использовать кредитное плечо в криптовалюте?

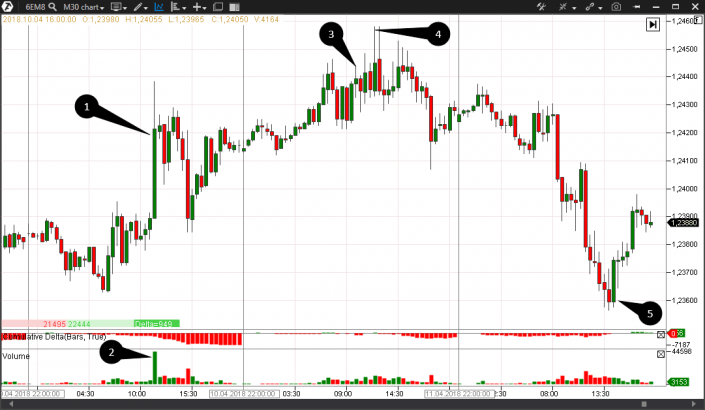

Видеоролик, объясняющий, как использовать технический анализ в системном трейдинге. Обсуждение факторов, влияющих на рынок, методов оценки текущего состояния, принятия взвешенных торговых решений. Разбирают основные термины и принципы, связанные с размещением и сведением ордеров на финансовых рынках.

Стратегии могут быть тесно связаны с графиками и волатильностью, а могут наоборот ориентироваться исключительно на новости компаний. Например, если компания сообщила об увеличении доходности за определенный квартал, то приобретение активов и будет считаться стратегий. То же самое работает и с трендами, техническим и фундаментальным анализом и другими индикаторами. Торги осуществляются через посредника — брокера, а все операция проводятся через торговый терминал — специализированное программное обеспечение. Программы доступны практически для каждого устройства, например, для персонального компьютера или мобильного телефона.

В книге представлена вся правда о том, как устроена биржевая торговля и финансовый рынок. Автор делится своим секретами успеха и честно рассказывает об ошибках и объясняет, как их можно было избежать. За 2 месяца вы узнаете, как выбирать блокчейн-проекты для инвестиций и в какие криптовалюты безопаснее вкладывать средства. Нужно влюбиться в эту деятельность, поэтому почитайте книги о трейдинге от успешных трейдеров прошлого. Торговля на бирже ценными активами с целью получения прибыли — это и есть трейдинг.

. Причем наибольшую сложность у меня вызывал именно процесс построения Фибо сетки на графике, — почему-то нигде толковых инструкций я в то время не нашел. В нижеследующем видео я попытался сделать именно такое руководство по использованию уровней Фибоначчи, какое пригодилось бы мне самому на начальных этапах. Другими словами, «Расширение Фибоначчи» — вспомогательный инструмент, используемый для определения потенциальных зон поддержки, сопротивления или разворотов цены в будущем.

. Причем наибольшую сложность у меня вызывал именно процесс построения Фибо сетки на графике, — почему-то нигде толковых инструкций я в то время не нашел. В нижеследующем видео я попытался сделать именно такое руководство по использованию уровней Фибоначчи, какое пригодилось бы мне самому на начальных этапах. Другими словами, «Расширение Фибоначчи» — вспомогательный инструмент, используемый для определения потенциальных зон поддержки, сопротивления или разворотов цены в будущем.