The company originally paid $4,000 for the asset and has claimed $1,000 of depreciation expense. This represents insurance premiums paid in advance, which will be expensed over time. This is because the insurance coverage provides future economic benefits to the business, similar to other assets. In order to properly understand what it means to debit and credit, let’s first get some widespread misconceptions out of the way. In double-entry accounting, every debit (inflow) always has a corresponding credit (outflow).

- The purpose of using credits and debits in accounting is to facilitate accurate and systematic record-keeping of financial transactions.

- Think of these as individual buckets full of money representing each aspect of your company.

- You need to implement a reliable accounting system in order to produce accurate financial statements.

- In order to properly understand what it means to debit and credit, let’s first get some widespread misconceptions out of the way.

Debits and Credits Accounting Formula

For example, if a company purchases inventory with cash, the Cash account will be credited, and the Inventory account will be debited. If a company pays off a loan, the Loan account will be debited, and the Cash account will be credited. Balancing the accounting equation is fundamental to ensuring the accuracy of financial records. When recording transactions, any change to one side must be equally offset on the other side. This process helps detect errors and provides a clear picture of a company’s financial health, allowing stakeholders to make informed decisions.

Liability Account

Within each, you can have multiple accounts (like Petty Cash, Accounts Receivable, and Inventory within Assets). Each sheet of paper in the folder is a transaction, which is entered as either a debit or credit. You can set up a solver model in Excel to reconcile debits and credits. List your credits in a single row, with each debit getting its own column.

Accounting Basics: Debit and Credit Entries

The Equity (Mom) bucket keeps track of your Mom’s claims against your business. In this case, those claims have increased, which means the number inside the bucket increases. Why is it that crediting an equity account makes it go up, rather than down? That’s because equity accounts don’t measure how much your business has. Rather, they measure all of the claims that investors have against your business.

Basic Accounting Debits and Credits Examples

A debit is an entry on the left side of a ledger, which indicates an increase in assets or a decrease in liabilities. A credit is an entry on the right current liabilities definition side of a ledger, which indicates a decrease in assets or an increase in liabilities. In the general ledger, debits and credits must always balance.

The journal entry includes the date, accounts, dollar amounts, and the debit and credit entries. You’ll list an explanation below the journal entry so that you can quickly determine the purpose of the entry. Bank debits and credits aren’t something you need to understand to handle your business bookkeeping. All changes to the business’s assets, liabilities, equity, revenues, and expenses are recorded in the general ledger as journal entries. Asset, liability, and equity accounts all appear on your balance sheet.

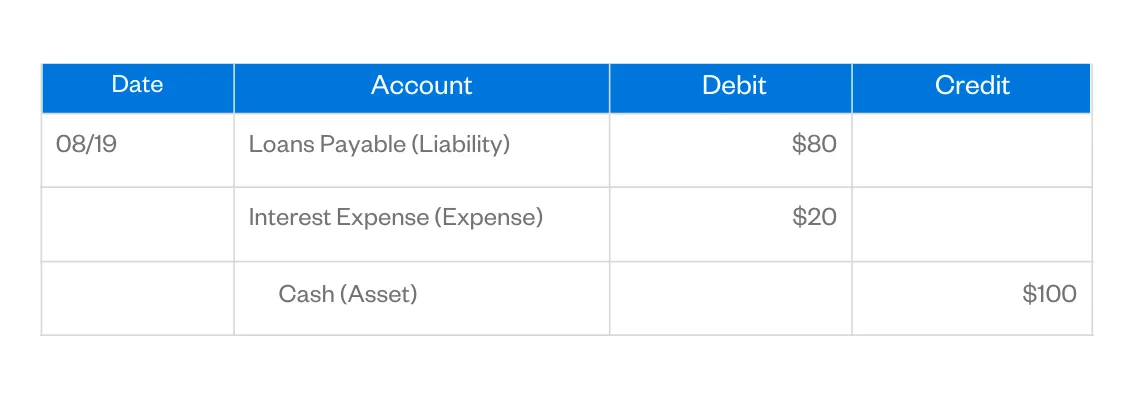

The next month, Sal makes a payment of $100 toward the loan, $80 of which goes toward the loan principal and $20 toward interest. This means that asset accounts with a positive balance are always reported on the left side of a T-Account. Debits and credits actually refer to the side of the ledger that journal entries are posted to. A debit, sometimes abbreviated as Dr., is an entry that is recorded on the left side of the accounting ledger or T-account.

Make it a habit to reconcile your accounts with your bank statements regularly — whether that’s weekly or monthly. In other words, compare your records to your bank balance to ensure everything matches. This process helps spot errors early, like missed transactions or duplicate entries and can prevent small discrepancies from turning into larger issues. Debits increase your expense accounts because they represent money going out. For instance, when you pay your employees, you debit the expense account to show the outflow of cash for wages. Assets on the left side of the equation (debits) must stay in balance with liabilities and equity on the right side of the equation (credits).

Debits and credits are a critical part of double-entry bookkeeping. They are entries in a business’s general ledger recording all the money that flows into and out of your business, or that flows between your business’s different accounts. Notice I said that all “normal” accounts above behave that way. Contra accounts are accounts that have an opposite debit or credit balance. For instance, a contra asset account has a credit balance and a contra equity account has a debit balance. For example, accumulated depreciation is a contra asset account that reduces a fixed asset account.