When paying the annual report fee, corporations are sorted into two categories. Always check both calculation methods to make sure your corporation is paying the lowest possible franchise tax. As your Registered Agent, we will send you tax reminders both by mail and email, well in advance of the due date. We offer a tax filing service for a small fee in addition to your Franchise Tax amount. For a discounted rate you can submit your Delaware Franchise Tax payment via our online Franchise Tax form. The online fee will vary depending on when the online payment is submitted.

How (and When) to File Delaware Corporate Franchise Taxes

Delaware Franchise Taxes for corporations are due by March 1 of every year. If the tax is not paid on or before March 1, the state imposes a $200 late penalty, plus a monthly interest fee of 1.5%. The term «Franchise Tax» does not imply that your company is a franchise business. These solicitations urge corporations to file information and send payment in the amount of $125.00 by a certain date in order to complete corporate meeting minutes on behalf of the corporation. An annual Franchise Tax Notification is mailed directly to the corporation’s registered agent. The Delaware Division of Corporations will require all Annual Franchise Tax Reports and alternative entity taxes to be filed electronically.

The difference would between these two calculation methods is over $84,000 dollars! Delaware would likely send ABC a bill for the higher amount, but ABC can actually save substantial money for growing the corporation and furthering its stockholders’ best interests. Any corporation that is incorporated in Delaware (regardless of where you conduct business) must file an Annual Franchise Tax Report and pay Franchise Tax for the privilege of incorporating in Delaware. If you’re interested in incorporating your business in Delaware or need to pay your Delaware franchise tax, consider posting a job to receive free custom quotes from one of UpCounsel’s top 5% of attorneys.

If the Annual Report and remittance is not received by the due date, a $125.00 penalty will be added to filing fee. If so, that document can be sent directly from the Delaware Secretary of State. This document certifies the date the company accounting was formed, that the company is current, and that the company is in good standing.

- The registered agent will charge a small fee to complete the filing of your Delaware franchise tax.

- It is based on the corporation type and authorized shares.

- Failure to file the report and pay the required franchise taxes will result in a penalty of $200.00 plus 1.5% interest per month on tax and penalty.

- The method is any that recovers more than $1 in tax for ever $1 spent within a four-year period.

- It’s essential for corporations to adhere to Delaware’s franchise tax requirements to maintain good standing.

- Therefore, if you receive a tax bill for tens of thousands of dollars, it may be in your best interest to try calculating your Delaware Franchise Tax with the assumed par value capital method.

Do I Need to Submit Anything Else With My Delaware Franchise Tax Payment?

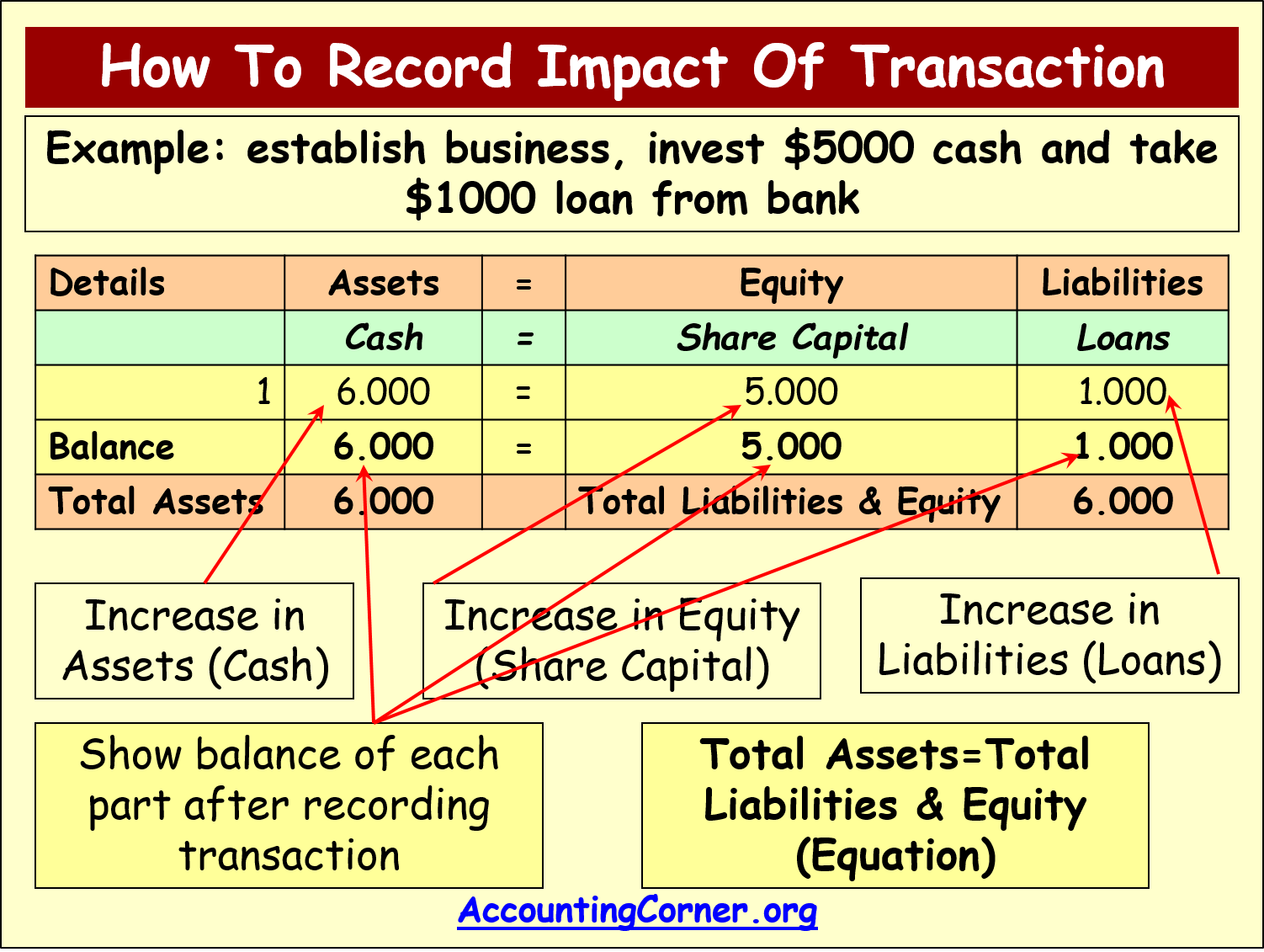

In order to utilize this filing method, you will need to provide the company’s total gross assets (as reported on Form 1120, Schedule L) and the total number of issued shares. The tax is then often calculated to the minimum payment of $400 tax plus the $50 annual report fee, for a total of $450 due per year. A corporation with 5,000 authorized shares or less is considered a minimum stock corporation. The Delaware annual report fee is $50 and the tax is $175 for a total of $225 due per year. To use this method, you must give figures for all issued shares (including treasury shares) and total gross assets in the spaces provided in your Annual Franchise Tax Report.

Annual Report and Tax Information

Franchise taxes in Delaware are an annual fee gross and net tax shield valuation that all corporations incorporated in the state must pay to maintain their legal existence. Instead, they are considered a cost of doing business in Delaware. Before we dive into more detail, your corporation may have received a franchise tax bill from the Delaware Division of Corporations for tens of thousands of dollars (or more)!

The total cost of the corporation’s Delaware Franchise Tax consists of an annual report fee and the actual tax due. Our Delaware Franchise Tax Calculator was developed to help you understand and plan for how much you’ll likely need to pay your Delaware Franchise taxes for your Delaware business. Delaware’s taxation structure has different tiers for LLCs, LPs, non-profit corporations, and for-profit corporations. Instead of doing hours of research on how to calculate Delaware franchise tax, use our tool to get answers in minutes.

Failure to pay franchise taxes on time can result in penalties and interest, which debit memo and credit memos in accounts payable can accumulate quickly. In extreme cases, non-compliance can lead to the administrative dissolution of the corporation. If your corporation is administratively dissolved, it technically doesn’t exist anymore, and any contracts, agreements, or other arrangements you enter into during administrative dissolution are void. Directors or officers taking action on behalf of the corporation during administrative dissolution expose themselves to personal liability and the risk of fiduciary duty lawsuits. A corporation with 5,001 authorized shares or more is considered a maximum stock corporation. The annual report fee is $50 and the tax would be somewhere between $200 and $200,000 per year, as illustrated below.