We’ll examine this business model’s concept in more detail and explain how it operates so that you can use it to your advantage. Additionally, your team can get real-time visibility into inventory levels and reduce errors that cut into profit margins. Everything from pricing to the consignment fee to storage location to time frame should be covered in a consignment agreement. The contract should benefit both parties as much as possible and offer fair terms for both sides. When a sale is made, the consignor (the product owner) gets a majority of the sale price back, while the consignee will take a small percentage for the effort of displaying and selling the product. Out of these goods, the consignee could sell food products equivalent to $3,500.

Guide to Understanding Consignment Inventory

As mentioned, when the consignor transfers goods to the consignee, the risks and rewards still remain. Therefore, the consignor doesn’t need to pass a journal entry to the accounts. When you sell wholesale, you sell products directly to a retailer in exchange for payment. However, the retailer is more like your salesperson in a consignment arrangement. That retailer may not take you up on your wholesale offer just yet, but they might consider selling your items on consignment in their store. It’s less risky for them and an excellent opportunity for you to grow your brand and bring in some extra money.

Reduced Risk of Obsolescence

Inventory carrying costs are the financial and inventory costs incurred by a company while holding a specific volume of inventory. In a nutshell, it refers to the expense of keeping the products in stock, owning them, or storing them. Consignors and suppliers can pay little or no holding expenses because they transfer ownership and are not required to hold onto is interest on a business credit card deductible the consignment items. As a result, they will have more cash available to use for other business-related costs. Effective management of consignment inventory requires clear communication, accurate tracking systems, and efficient logistics. Establishing transparent agreements outlining terms and conditions is essential to avoid misunderstandings and disputes.

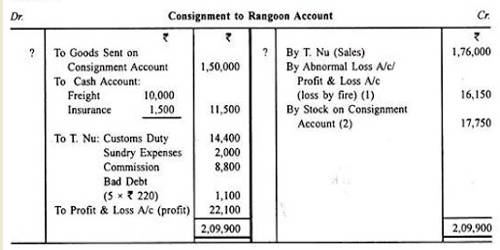

Consignment Accounting Example

In double-entry accounting, the shipping charges are accounted as a debit, while a credit is placed for accounts payable. In order to record the transactions mentioned above, it can be seen that a different treatment is required for the transfer of inventory, the sale of inventory, and the return of the inventory. In the case where the consignee sells the goods, the consigner can then record it as a sale made in the financial statements. In other words, inventory that is initially sent out to the consignee is only recorded as a sale, once the consignee sells the inventory.

Balance Sheet

Here we summarize what we see as the main differences on inventory accounting between the two standards. Consignment accounting refers to the accounting methods and practices used to record and report transactions related to consignment arrangements between a consignor and a consignee. Communication between the consignor and consignee is another critical aspect of effective inventory management. Regular updates on sales performance, stock levels, and market trends can help both parties make informed decisions. For instance, if certain items are not selling as expected, the consignor may decide to adjust pricing or replace the stock with more in-demand products. This collaborative approach can optimize inventory turnover and enhance profitability for both parties.

- The consignor must wait until the consignee sells the goods to a third party before recognizing revenue.

- This involves tracking the goods sent to the consignee as “inventory on consignment,” a distinct category that separates these items from regular inventory.

- A shoe store might collaborate with a small designer to sell some of the designer’s products in-store.

- This scenario necessitates robust tracking systems to monitor the status of consigned goods and accurately forecast revenue.

Consignment inventory accounting is problematic for both the consignor and the consignee. In consignment contracts, the retailer is the consignee, and the supplier is the consignor. The transfer of ownership from supplier-owned inventory to retailer-owned inventory is called consumption. He has a CPA license in the Philippines and a BS in Accountancy graduate at Silliman University. Second, they need to record COGS by debiting cost of goods sold and crediting consignment inventory. As mentioned, the consignor must use two double entries to record the transaction.

This model can offer significant benefits such as reduced inventory costs and expanded market reach. Traditionally, when a business works with a retailer, the retailer pays for that business’s products upfront – before they’re able to sell them in their store. The business makes a profit right then and there as they exchange their products for profit. On the flip side, the retailer has to sell the products to customers before making any money. When the goods are sold, the consignee records a sale and reduces the inventory and liability accounts. The amount recorded as sales would be the selling price of the goods, less a commission paid to the consignor.

We said in the last section that managing consignment inventory differs from your regular stock. However, many businesses need to pay attention to this and end themselves in trouble. Select inventory management software that can assist you in managing your consignment inventory, and you may avoid this problem.

This distinction is vital for accurate financial reporting and for understanding the true availability of stock. Utilizing advanced inventory management software can streamline this process, offering features like automated tracking, real-time updates, and detailed analytics. Implementing robust inventory management systems and leveraging data analytics can optimize decision-making and drive profitability. Unleashed inventory management software gives retailers, wholesalers, and their suppliers the ability to track stock across multiple warehouses and geographical locations.

Even though these goods are still owned and possessed by the consigner, it is considered good practice to create a separate account to record all the inventory movements in the company. In this regard, the main objective of the holder is to sell the inventory on the behalf of the initial owner of the inventory. From the consignee’s perspective, there is no need to record the consigned inventory, since it is owned by the consignor. It may be useful to keep a separate record of all consigned inventory, for reconciliation and insurance purposes.

In the conventional approach to inventory management, retailers buy products from suppliers in advance and assume responsibility for unsold items. However, an alternative supply chain strategy transfers the burden of inventory costs from retailers to suppliers. This consignment inventory model involves the manufacturer, wholesaler, or supplier retaining ownership of the goods until the retailer successfully sells them to customers. In this scenario, the retailer pays the supplier only for the sold goods and can return any unsold items. Consignment allows businesses to sell goods via third-party sellers without requiring the sellers to pay for the goods upfront.